If you're a sharing economy or mobility platform operator grappling with the frustration of soaring insurance costs, you're in the right place.

In this blog, we'll delve into a transformative solution that addresses your cost concerns and has the potential to elevate your platform's profitability: embedded insurance.

Traditional approaches often leave sharing economy platforms feeling the heat of high costs, uncertain risk management, and a lack of innovation. Embedded insurance is a new path to profitability, offering flexibility, customization, and strategic advantages that pave the way for increased profitability.

Navigating the pitfalls of traditional insurance

With everything you’re doing managing costs for your platform, you may not realize that your insurance program is blocking your growth.

Part of the problem is that the status quo is to manage the insurance program like a cash business. For example—

If the carrier charges $30 to cover a vehicle for a day, you’d naturally pass that $30 to the customer. But just as the cost of owning a home isn’t only your mortgage payment, the cost of your insurance program is not just the premium price. You can increase profit by better understanding your costs (e.g., carrier costs, claims that still fall to the platform, staffing) and maximizing your revenue (e.g., accurately pricing higher-risk situations so that you don't need to turn them down or lose money from the rental).

High insurance costs can be a major obstacle for platforms, affecting revenue and growth. Traditional carriers play an important role, but their rigid structures can be frustrating when balancing profitability and risk. This struggle is amplified when identifying and managing bad actors or trying to make higher-risk drivers profitable without increasing decline rates.

Moreover, the limitations imposed by traditional carriers extend to your platform's offerings. The inability to swiftly secure insurance for new products or services stifles innovation, hindering your competitiveness. On top of this, prioritizing efforts and allocating resources becomes complicated, compounded by low visibility into crucial performance metrics.

What is embedded insurance?

Just as they’ve changed how their users navigate, shared economy and mobility platforms must get creative to claim ownership of their insurance program and better control costs.

Embedded insurance is insurance that's built directly into your sharing economy platform. Users can purchase insurance at the point of sale, securing them coverage immediately and in a single transaction. Embedded insurance safeguards transactions, helps instill brand trust, and elevates the overall user experience.

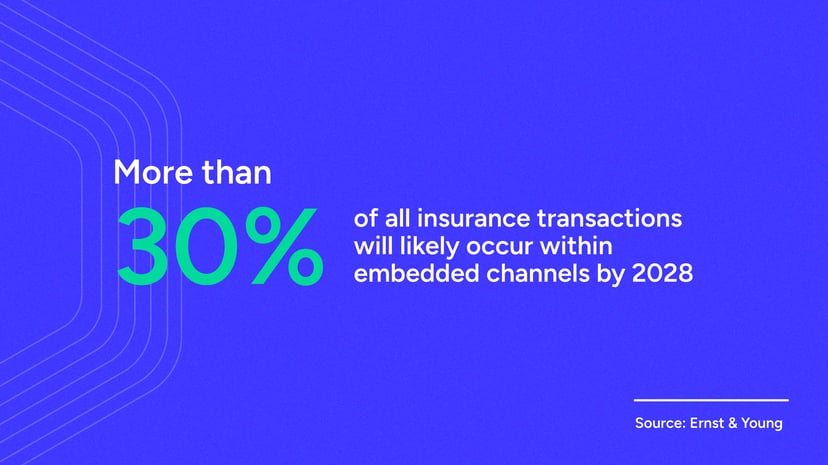

Carriers and companies alike are eager to jump on this new wave, giving traditional insurance a much-needed increase in digital presence. According to Ernst & Young, more than 30% of all insurance transactions will likely occur within embedded channels by 2028.

Another survey found that 63% of consumers would enroll in embedded insurance if it was available at the point of purchase. Some of the reasons why consumers prefer embedded insurance over traditional insurance include reliability of service, ease of understanding, and an easier claims process.

Embedded insurance is all about mitigating risks and enhancing the value you offer to your users. It’s the backbone of a resilient sharing economy ecosystem, whether safeguarding rental transactions, protecting against cancellations, or ensuring the safety of shared assets.

Unlock profitability with embedded insurance

The frustration with high insurance costs often stems from the traditional approach that many sharing economy platforms adopt. However, embedded insurance has the potential to boost your platform's profitability significantly.

Identify and manage risk—then price accordingly

Embedded insurance offers a more dynamic and flexible approach to risk management. Unlike traditional carriers, which may struggle to adapt to the nuances of your platform, embedded insurance allows you to offer coverages tailored to your customers' wants and needs. This means a more dynamic approach to identifying and managing bad actors or potential risk factors. Customizing insurance solutions gives you greater control over your financial exposure, leading to a more secure and profitable operation.

Turn risks into opportunities

One of the key advantages of embedded insurance is how it turns higher-risk users into profitable opportunities. Instead of declining potentially lucrative users or accepting excessive risk, embedded insurance enables you to create customized plans that strike the right balance.

For example, a driver who needs a car while their vehicle is in the shop will have a different risk profile than a renter who needs a vehicle to take on a cross-country vacation—and should be priced accordingly. Taking these factors into account enhances profitability and fosters a more inclusive platform, attracting a broader user base without compromising security.

If you’re actively working to control your loss ratios, you can plan for how much the user will cost. Learn why sharing economy and mobility companies must track this crucial metric.

Expand offerings without higher costs

Embedded insurance liberates sharing economy platforms from the constraints of traditional carriers while still including the insurance you need to operate. Once free, your platform can integrate new products and services in a snap. The flexibility it provides empowers you to innovate without the roadblocks of delayed approvals or limited coverage options. Whether you're introducing a unique rental model or launching an innovative service, embedded insurance opens the door to a world of possibilities, driving growth and differentiation in a competitive market.

Make better-informed decisions

When handling your own insurance program through embedded insurance, it’s easier to track key performance metrics. These numbers give you the insights you need for informed decision-making. Traditional carriers often lack transparency and may even obscure metrics. With embedded insurance, you gain a comprehensive understanding of your platform's performance, allowing for data-driven strategies to enhance profitability and user experience.

Customize your insurance program with embedded insurance

Embedded insurance is not just a solution to the challenges posed by traditional carriers; it's a strategic tool for unlocking profitability. By customizing insurance offerings to align with your platform's unique dynamics, you mitigate risks effectively and create a foundation for sustainable growth.

Embedded insurance programs are one way platforms can better handle high insurance costs. Learn more about what's driving these costs ad how to control them in our guide, Navigating Insurance Costs in the Sharing Economy.