Loss ratios are a crucial insurance metric that can have a significant impact on the profitability of sharing economy businesses. They might sound complex, but understanding loss ratios is easier than you might think, and taking control of them can greatly influence your company's revenue goals.

Let’s explore why loss ratios are so important to the sharing economy and how you can proactively lower your loss ratio and increase profitability.

So, What exactly are loss ratios in insurance?

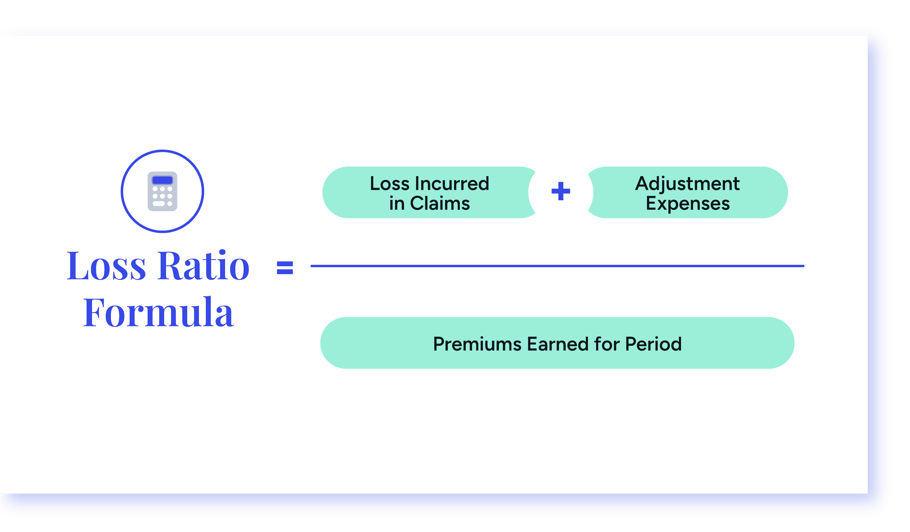

In simple terms, a loss ratio is the ratio of the total amount of claims paid out by an insurance company to the total amount of premiums collected from policyholders. It's a way for insurance companies to gauge their financial health and the profitability of the policies they offer.

The lower the loss ratio, the more profitable the company. A good loss ratio is 60–70%; if the loss ratio is more than 1 or 100%, it means big trouble for the company.

The loss ratio is a lagging indicator that signals to carriers how much they should charge for premiums. Because this year’s claims are next year’s premium, your loss ratio is an important number to monitor when planning for future growth.

For example, if your company's insurance premiums bring in $100,000 per year and your projected claim losses are $150,000 per year, the insurance company's loss ratio is well over 100%. In this scenario, they'll have to raise premiums by 50% to just break even—so the increase will likely be even larger. This can seriously impact your company's bottom line and ability to grow.

Loss ratios are a major reason why premiums are spiking, especially for auto insurance. The auto insurance industry reported its worst underwriting results in over two decades in 2022, with a net combined loss ratio for the sector of 111.8. It’s no wonder then that insurers also wrote a record number of premiums in Q1 2023 to help make up for the losses.

For startups and tech businesses in the sharing economy, loss ratios take on even more importance. The nature of these businesses often involves risk that are unique and constantly evolving. Additionally, many traditional insurers don't understand the unique needs of sharing economy companies, so finding lower premiums can be especially tough for these businesses. This is where understanding and strategically managing your loss ratios can make a world of difference.

Proactively lower your loss ratio

The good news is that loss ratios don't have to be something that just happens to you. They aren’t some mysterious force influencing your company’s fate. Like any KPI, loss ratios can be influenced and managed to align with your revenue goals. By implementing effective risk management strategies, you can take control of your loss ratios and, in turn, your financial outcomes.

Here are a few steps to help you get started on strategizing your loss ratios.

Set clear targets

Losses might be inevitable, but they don't have to be unpredictable. Define clear targets for your loss ratio that you can reasonably achieve. Providing clarity around your expectations and outlining clear steps helps demystify the process and sets a practical foundation for your risk management strategy. Consulting firm McKinsey has actionable tips for lowering you loss ratio by 5 percentage points.

Put your data to work

Data is your ally in the battle against high loss ratios. Build a comprehensive data set that you can use to review your screening rules. By analyzing clean data, you can refine your approach, tighten up where necessary, and identify problem areas that may be contributing to higher losses. To learn more about what's involved in setting up your own data set, check out this article from McKinsey.

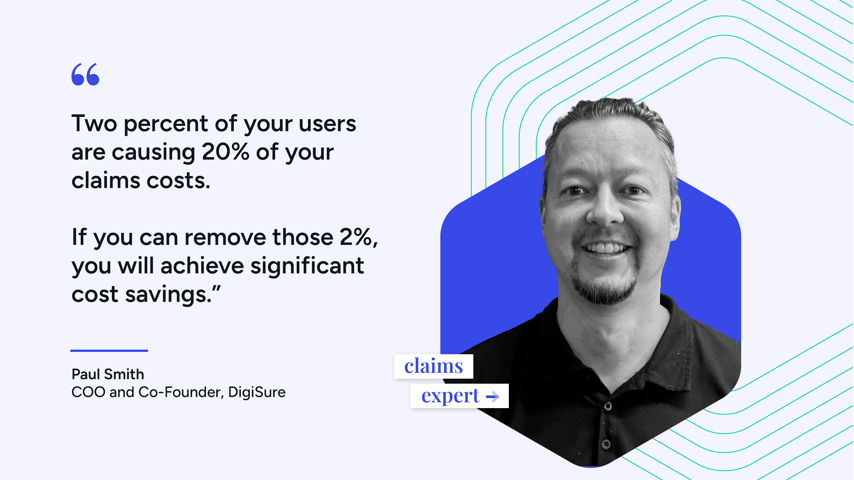

Tighten your screening criteria

Not all customers are created equal when it comes to risk. Identify segments of customers that are causing a disproportionate amount of losses. If tightening your screening criteria can help weed out high-risk individuals, take action. The decline of high-risk customers can lead to a significant reduction in overall losses, and thus lower your loss ratio.

Lower your adjustment expenses

Another factor you can actively work to lower to improve your loss ratio is the cost of claims adjustments. A streamlined claims handling process minimizes the impact of expenses and helps you close claims faster, lowering your expenses.

Take a holistic approach

Your risk management approach is a part of your larger corporate strategy. Don't just present it as a standalone concept. Connect it to your overall business goals and strategies to emphasize its importance and impact.

Start lowering your loss ratio

So your loss ratio is costing you too much. Now what?

Remember, taking control of your loss ratios isn't just about avoiding financial losses; it's about positioning your startup or sharing economy platform for long-term success. A well-managed loss ratio not only helps you maintain a healthy bottom line but also enhances your reputation in the industry, fosters trust among stakeholder, and can even lead to more favorable terms with insurance providers.

So, next time you're evaluating you business strategy, keep in mind the importance of loss ratios—a secret weapon for sharing economy success.

Eager to lower you loss ratio but not sure how to get started? DigiSure can help. Our Protection-as-a-Service platform streamlines you insurance processes and helps you lower costs. Request a demo to learn more.