![]() PolicyHub

PolicyHub

Connect it all with PolicyHub

Easily track and manage your policies from quote to claim. Our all-in-one solution helps you save money on insurance costs and even earn money with embedded insurance options.

PolicyHub serves as the backbone to your insurance program.

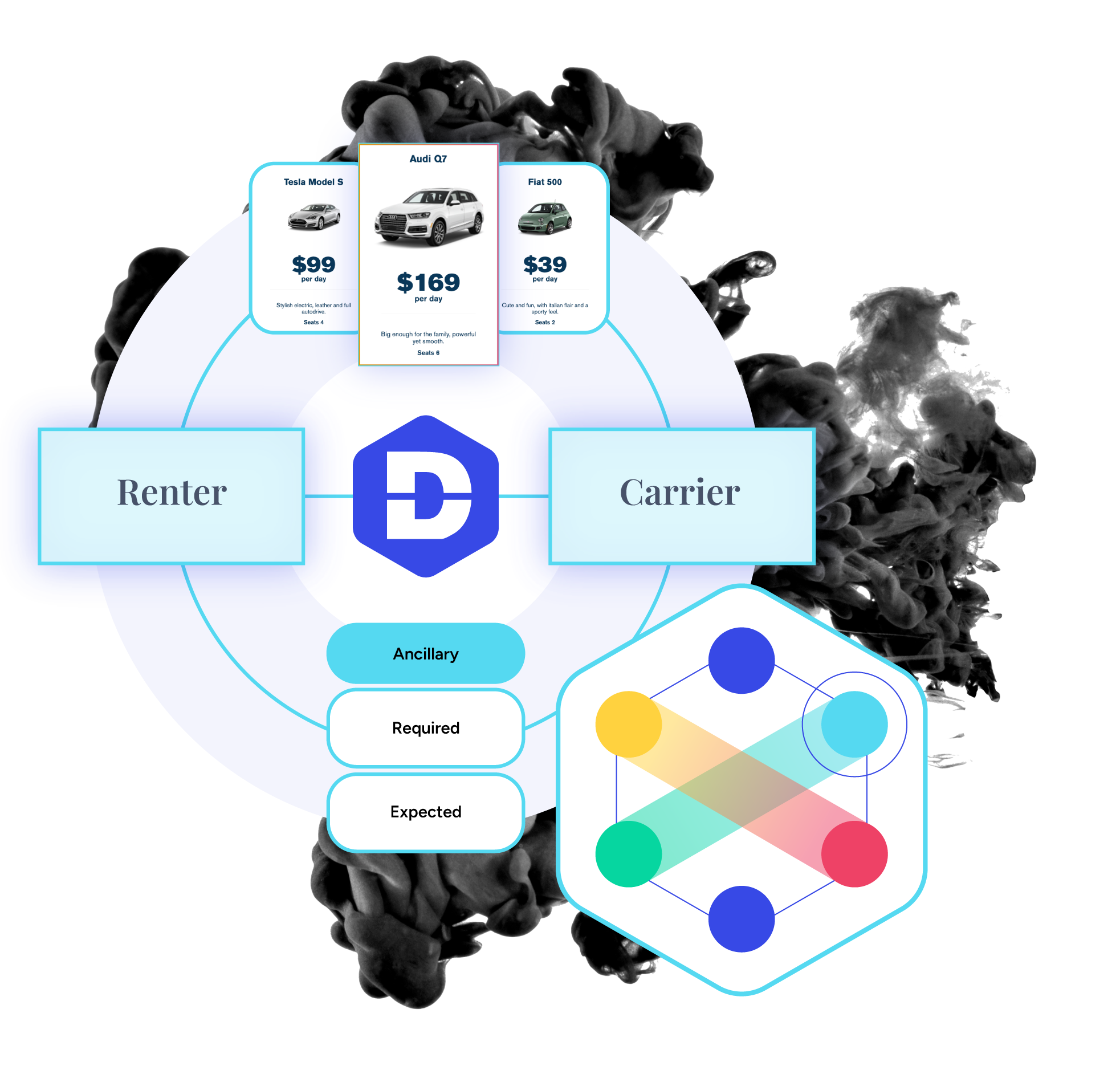

DigiSure's PolicyHub service streamlines the connection between insurance policies and customer protection plans via embedded insurance.

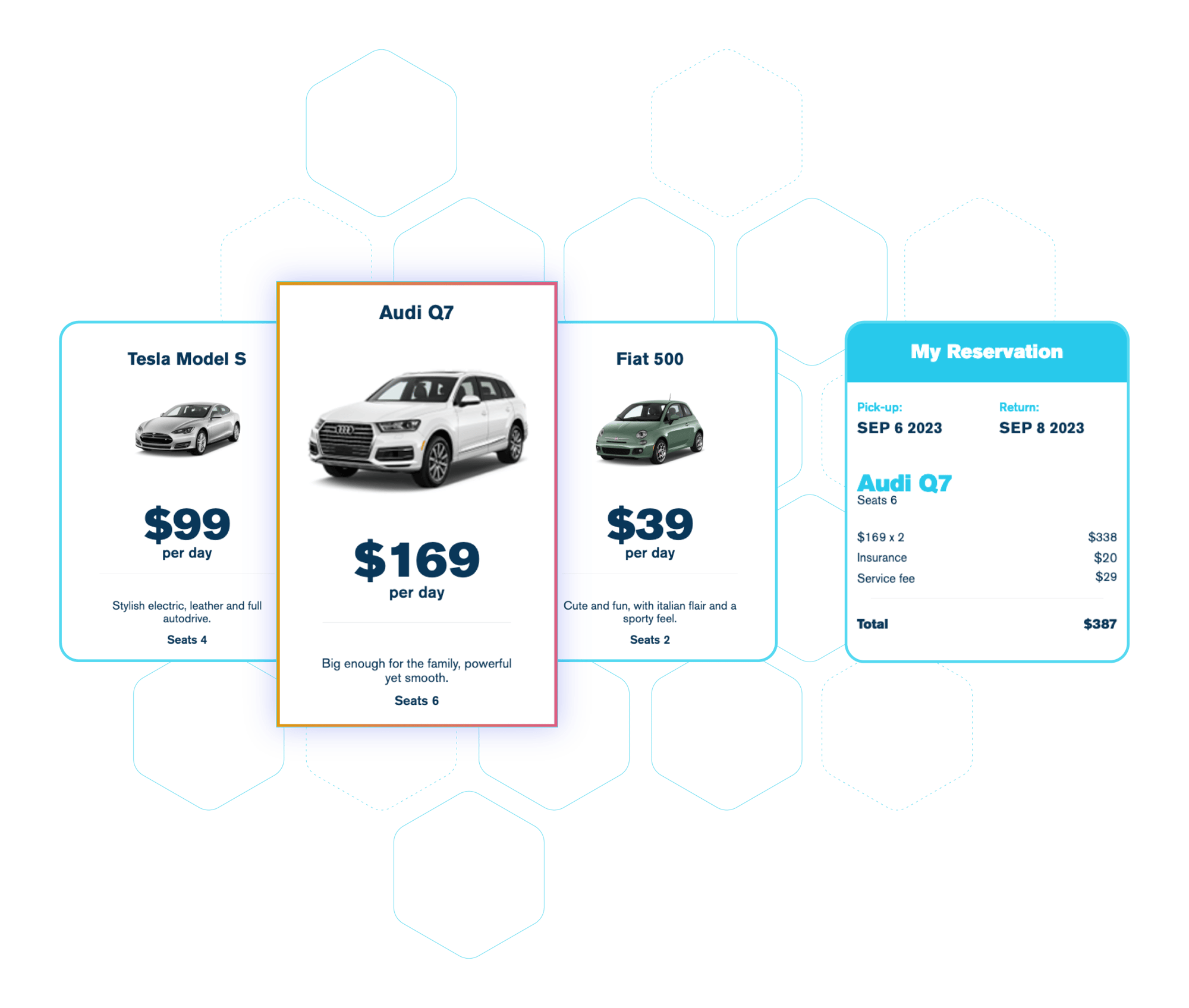

Platforms can A/B test pricing for conversion, offer dynamic pricing, manage micro policies, and issue insurance cards. Additionally, we offer a streamlined First Notice of Loss (FNOL), accelerating the claims process and enhancing customer satisfaction.

Save money by making your business more attractive to carriers

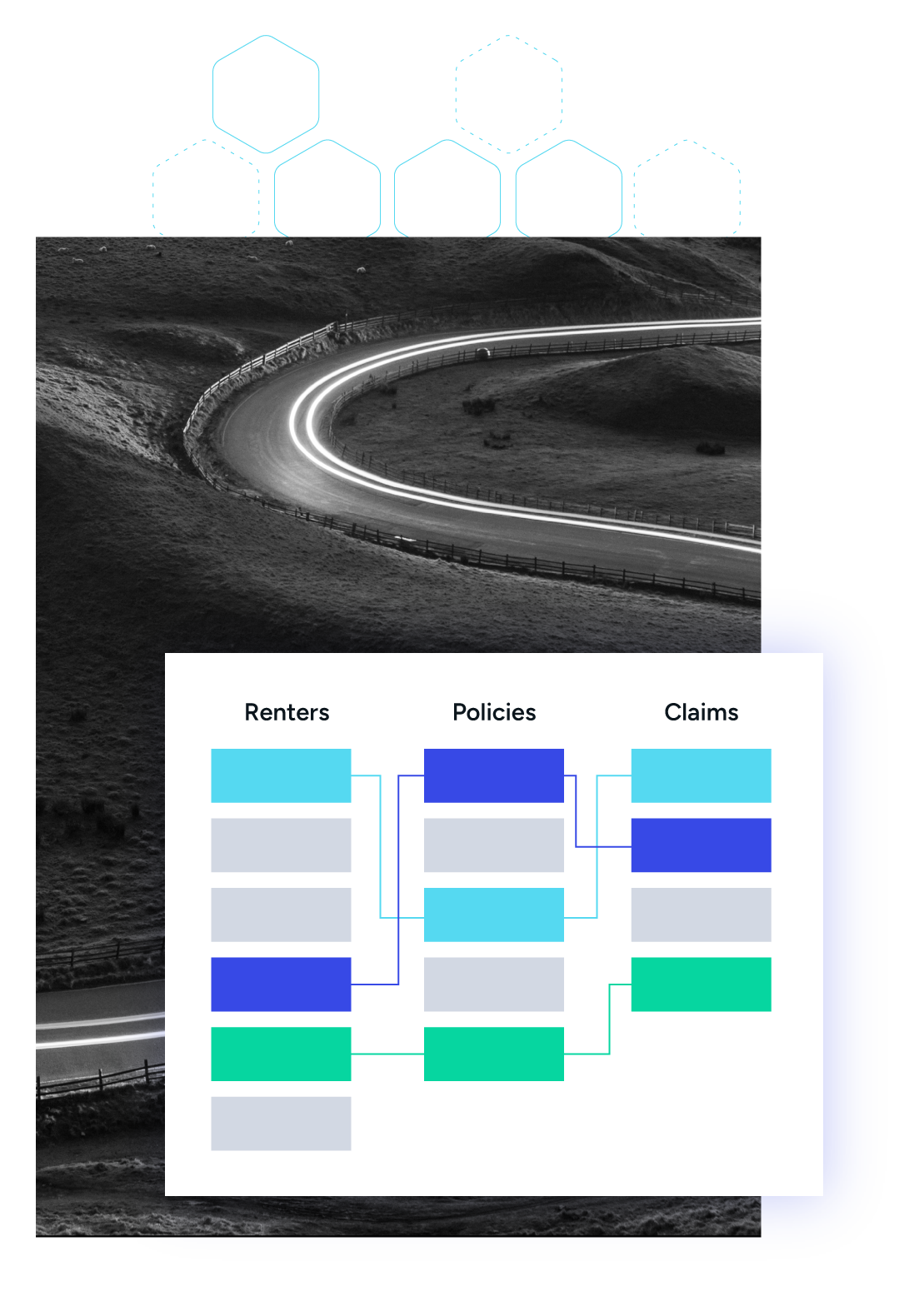

Build the data sets you need

PolicyHub allows you to connect and manage everything related to your insurance program in one system. You can structure protection plans your customer want, confidently generate revenue, and manage the multiple insurance products that support these plans. By connecting departments and teams in PolicyHub, you are building your own clean data set, which will allow you to improve insurance options and grow your business. With DigiSure's PolicyHub, user data, policy data, and claims data are all linked together to provide actionable insights and access to transactional data.

Know your worth and back it up with data

Advocate for what you deserve with visibility into your programs. Past performance doesn't necessarily predict future outcomes. DigiSure's PolicyHub system provides comprehensive data to confidently negotiate improved terms with insurance carriers.

Bring your risk in-house in a responsible way

DigiSure's PolicyHub system enables efficient self-insured retention (SIR), empowering your company to retain a larger portion of risk while relying on insurance carriers only for higher-level risks. You can centralize and manage your insurance coverage effectively, allowing for precise risk management and financial planning. Launch the system with an existing SIR program or integrate it concurrently, depending on your needs.

A responsibility run Self-Insured Retention program can save you 30% off the cost of your insurance program. See how DigiSure helped a partner do just that, from signing to launch in just 4 months.

Maximize your revenue with embedded insurance and dynamic pricing

Produce additional revenue by offering the protection packages at checkout:

Layer benefits with admitted products and warranties blended together

Increase conversion with the coverage your customers want to purchase

Launch new programs with the insurance you need to cover it (e.g. delivery, or campground coverage)

"Part of the RV camping experience is actually outside the RV, when you invite friends over for food and fellowship. This provided a unique liability gap that wasn't being addressed in the industry. RVshare consulted with DigiSure and our insurance carriers to build a campsite liability coverage that is now part of each of our package offerings. This is what partnership is all about: identifying a need and finding a collective solution that also differentiates ourselves in the market.”

— Brian Rogers,

President - Insurance, Protection Products & Ancillary Revenue, RVshare

Generate dynamic pricing based on user information:

Offer your more profitable users a better price and keep them coming back

Accurately price the risk of different user cohorts so that low-risk users aren’t covering the cost of higher-risk users

Test pricing to maximize conversion and margin

Features

Rating/pricing

Our rating engine supports unlimited factors

Policy tracking

Our platform tracks your details in one place to speed up claim handling, reduce fraud, and support usage-based pricing

Price optimization

Our platform lets you A/B test multiple price plans and trade conversion for risk